Imf Loan Conditions To South Africa

africa south wallpaperThe R707 billion loan to South Africa by the International Monetary Fund IMF has sent tongues wagging as it is feared the fund will impose structural adjustment programmes that will force the. While South Africas new IMF loan does not come with any binding conditions Finance Minister Tito Mboweni and the SARB Governor Lesetja Kganyago have signed what looks like a non-binding letter of intent in which they outline plans for treasury to introduce a debt ceiling zero based budgeting reduced spending on wages and improved governance of SOEs.

Does Brics Banking Offer An Alternative To The Imf And World Bank Pessimistic Signals From South Africa

The IMF requires that South Africa repay the funds to the IMF over 20 months beginning 40 months after the loan is disbursed.

Imf loan conditions to south africa. South Africas 43 billion emergency facility from the International Monetary Fund will be released on Wednesday and the country will only start repaying the loan in 2023. South Africa Looks Toward Inclusive Recovery to Stabilize Debt Boost Growth. The 43bn loan the IMF is extending to South Africa does not come with typically tough conditions such as cutting state costs to the bone.

This means that South Africans will need to ensure that the funds to. But the conditions that come attached to these loans are seldom told by governments to their citizens. Yet on July 27th South Africa said it had agreed to a 43bn IMF loan.

The IMF and World Bank want to crash every major economy with the intent of buying over every nations infrastructure at cents on the dollar. The deal signed by South Africa one of 78 countries to have received covid-related help is not a standard IMF programme and thus does not have stringent conditions. The Executive Board of the International Monetary Fund IMF today approved South Africas request for emergency financial assistance of SDR 30512 million US 42865 million or 100 percent of quota under the Rapid Financing Instrument RFI to meet the urgent balance of payment BOP needs stemming from the outbreak of the COVID-19 pandemic.

This means that South Africans will need to ensure that the funds to. A Rapid Financing Instrument is far less stringent than. The deal signed by South Africa one of 78 countries to.

In other words the World Bank the IMF the International Monetary Fund and the WTO the World Trade Organization are the triple enemies of progress in almost every developing country in the world today. Take a country like Ghana for example. The IMF approved a 43 billion loan at only 11 interest with the first repayment due in 2023.

Now the administration of president Muhammadu Buhari has taken a 34 billion loan from the fund. Consequently the funds will be subject to the same procurement and accounting requirements as all other budgetary expenditure. The International Monetary Fund agreed to lend South Africa 43 billion the largest loan any African country has received since the start of the coronavirus crisis underscoring the force of the.

The conditions attached to South Africas R70 billion IMF loan The Conversation 28 July 2020 The International Monetary Fund IMF has approved a R70 billion US43 billion loan for South Africa. In a conversation with IMF Country Focus the Director-General of South Africas National Treasury Dondo Mogajane explains how the government has responded to the COVID-19 crisis how IMF financing will help to stabilize the economy and strategies for addressing debt and spurring growth. The IMF loan does not impose any conditions over and above what is in South African law on how the funds can be used.

While the IMF has not imposed any conditions on this loan the institution obviously expects that through disciplined sound and pro-growth fiscal policy the South African government will ensure. Now lets see how the World Bank IMF and WTO operate in Sub-Saharan Africa. Get instant email alerts South Africas president Cyril Ramaphosa unveiled fiscal spending worth a tenth of the countrys output including a first ever request for an IMF loan to stir Africas.

Wary of the conditions that could come with broader support programs from the IMF and other. But the need for it nevertheless reflects the extent of the countrys underlying economic problems. South Africa applied to the IMF for funding through its Rapid Financing Instrument designed to support countries struggling with sudden crises such as the economic fallout from the COVID-19 pandemic.

Yet on July 27th South Africa said it had agreed to a 43bn loan from the IMF. Huge foreign loans are given to sovereign nations by the World Bank IMF and the likes. The IMF requires that South Africa repay the funds to the IMF over 20 months beginning 40 months after the loan is disbursed.

Opposition to the IMF has remained a shibboleth of the party.

Local South African Economic Conditions

Local South African Economic Conditions

Best In Economics This Week September 25 Groundwater Earth Nasa

Best In Economics This Week September 25 Groundwater Earth Nasa

سعر الذهب اليوم في مصر الجمعة 16 12 2016 مقابل الجنيه المصري بمحلات الصاغة متوسط عيار 21 589 جنية Log Signup Signs

سعر الذهب اليوم في مصر الجمعة 16 12 2016 مقابل الجنيه المصري بمحلات الصاغة متوسط عيار 21 589 جنية Log Signup Signs

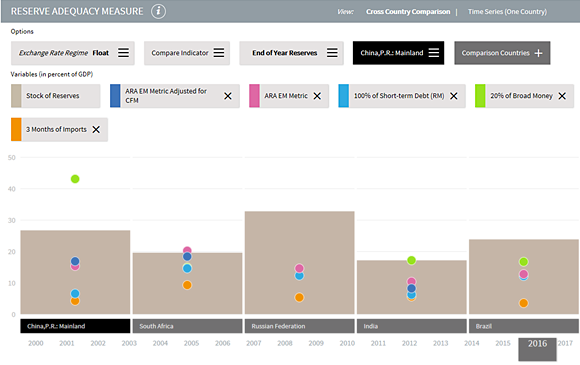

South Africa South Africa Financial System Stability Assessment

South Africa South Africa Financial System Stability Assessment

Last Week In Brief Wrap Of China S Financial News In The Week Ending Oct 13 Financial News Financial Finance Saving

Last Week In Brief Wrap Of China S Financial News In The Week Ending Oct 13 Financial News Financial Finance Saving

Government Finances Surplus Deficit And Debt Statistics South Africa

Pin By Curiosity Publishers On Original Content Rocks Bar Chart Activities

Pin By Curiosity Publishers On Original Content Rocks Bar Chart Activities

This News Could Not Be Found Initial Public Offering Finance Firm

This News Could Not Be Found Initial Public Offering Finance Firm

South Africa Looks To Structural Reform Last Investment Grade Credit Rating Falls

South Africa Looks To Structural Reform Last Investment Grade Credit Rating Falls

This Time The Imf Is Not To Be Feared The Mail Guardian

This Time The Imf Is Not To Be Feared The Mail Guardian

Https Www Imf Org Media Files Publications Covid19 Special Notes Enspecial Series On Covid19government Support To Stateowned Enterprises Options For Subsaharan Afric Ashx

This News Could Not Be Found Global Scandal Credit Rating

This News Could Not Be Found Global Scandal Credit Rating

Sindzingre Alice 2009 Financing Developmental Social Policies In Low Income Countries In Katja Hujo An Social Policy Political Economy Social Development

Sindzingre Alice 2009 Financing Developmental Social Policies In Low Income Countries In Katja Hujo An Social Policy Political Economy Social Development

Covid 19 And Africa Socio Economic Implications And Policy Responses

Covid 19 And Africa Socio Economic Implications And Policy Responses

Ts And Cs Apply What The Imf Loan Means For The Future Of Sa S Economy

Ts And Cs Apply What The Imf Loan Means For The Future Of Sa S Economy

Is Sa S Imf Loan About Economics Or Politics New Frame

Is Sa S Imf Loan About Economics Or Politics New Frame

Why South Africa Shouldn T Turn To The Imf For Help

Why South Africa Shouldn T Turn To The Imf For Help