Va Home Loan Interest Rates Reddit

interest loan redditThe average APR on a 15-year fixed-rate mortgage remained at 2329 and the average APR for a 51 adjustable-rate mortgage ARM fell 1 basis point to 2959 according to rates provided to. VA Loans Laredo VA Loans Laredo provides several home loan programs for people looking to buy a house.

Credit Repair Reddit Credit Repair Companies In Texas The Credit Repair Bible Credit Cards Credit Repair Business Credit Repair Credit Repair Companies

Therefore the actual payment obligation will be greater.

Va home loan interest rates reddit. Benefits requirements and. For example a score from 600-620 will qualify for the same rate but a score from 621 to 640 will put you at a lower interest rate. It is also possible to refinance adjustable-rate mortgages ARM into fixed-rate mortgages.

With a credit score between 600 to 620 you will probably have the second highest interest rate for your VA backed loan. Taxes and insurance not included. To calculate the APR simply divide the annual payment of 12300 by the original loan amount of 200000 to get.

A good general rule of thumb for VA inerest rates is that they should normally be about25-375 lower than other non VA loans. Interest Rate Reduction Refinancing Loans. A VA loan of 250000 for 15 years at 2000 interest and 2465 APR will have a monthly payment of 1609.

For whatever reason closing cost are a bit lower when using a VA loan have your real estate agent explain it to you. Credit scores like a 605 610 or 615 are well below the national average score of 699. The average 15-year fixed mortgage rate is 2350 with an APR of 2690.

On Monday January 25 2021 according to Bankrates latest survey of the nations largest mortgage lenders the average 30-year VA loan rate is 3100 with an APR of 3370. What is a VA Loan. I had the seller cover all the closing cost about 10000.

VA Home Loans are provided by private lenders such as banks and mortgage companies. 2250 2596 15-Year Fixed VA Purchase. Meanwhile The Mortgage Reports says its survey shows rates on both FHA loans and VA loans are at an average 25.

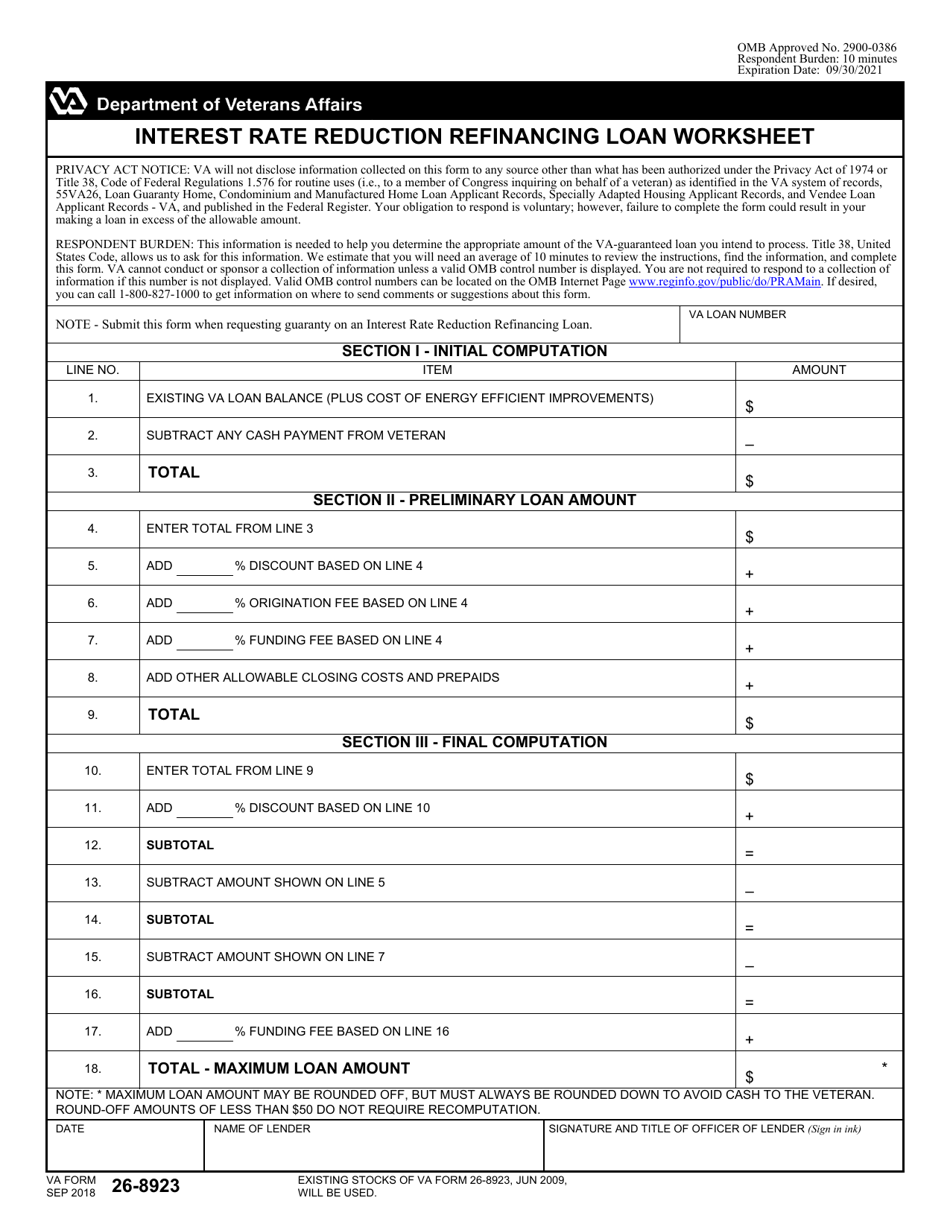

A VA loan of 250000 for 30 years at 2125 interest and 2392 APR will have a monthly payment of 940. VA Loan Type Interest Rate APR. Also called IRRRL they can be used to lower interest rates by refinancing existing VA loans.

One of the nations biggest home lenders is moving swiftly to take conventional. Your resource for free mortgage rate quotes and informative articles about home loans including all aspects of the home loan application and approval process. A VA approved lender.

The average VA loan interest rate as of August 21 2020 is 2890 for a 30-year fixed mortgage. The 51 adjustable-rate mortgage ARM rate is 3000 with an APR of 4000. The average VA loan interest rate as of July 8 2020 is 25 for a 30-year fixed mortgage.

1400 Veterans United Dr Columbia MO 65203. Each VA approved Lender sets its own VA mortgage rates on a daily basis. 2019 - 10 min read The VA home loan.

VA guarantees a portion of the loan enabling the lender to provide you with more favorable terms. Customers with questions regarding our loan officers and their licensing may visit the Nationwide Mortgage Licensing System Directory for more information. The average 30-year VA.

A VA loan also known as a Veterans Affairs loan is a mortgage option backed by the United States government that requires no down payment and has easier qualifications for military service members and their spouses. 2250 2744 30-Year Streamline IRRRL 2625 2796 15-Year Streamline IRRRL 2250 2564. There are many benefits to a VA loan but one of biggest benefits is that no down payment is needed to purchase a home.

Purchase Loans Help you purchase a home at a competitive interest rate often without requiring a downpayment or private mortgage insurance. Let our mortgage loan experts help you find the loan. Providing an open forum for all mortgage related questions to be asked and answered by real mortgage professionals.

30-Year Fixed VA Purchase. The 6 interest rate is then used to calculate a new annual payment of 12300. There are three types of VA loans.

In the world of interest rates so much can change in a relatively short amount of time. The Department of Veterans Affairs does not set the VA loan rates nor does it lend money. Of Veterans Affairs or any government agency.

Not endorsed or sponsored by the Dept. Purchase loans interest rate reduction refinance loans or IRRRL also referred to as a VA streamline refinance loan and cash-out refinance loans. VA loan has a loan fee kinda of like a minimum down payment but they roll it into the financing so it came out to 315800.